IRAS Tax Relief

For a long time, paying income tax doesn't apply to me because I was earning too little for them to tax, it was only in 2011 that I started to earn enough to be required to pay in cash.

On Wednesday, while looking through my tax forms, I saw the NSman Self Relief and Earned Income Relief which reduced my taxable amount by a total of S$4000. So I looked them up on IRAS website and found that I was actually eligible for two other claims. You can check out the full list of reliefs here.

Spouse Relief

I am eligible for this one because my wife is not working, so I can claim S$2000 for this. I have never made the claim, but luckily when I checked with IRAS via email, seems like it is possible to claim retrospectively, I was married in 2010 so I can start claiming from there.

Parent Relief

I can claim S$7000 for this on my mother because she is not working, but my brother-in-law has made the claim and there can only be one claimant, when I checked with him, he told me he can withdraw if I wish to claim but I decided to let him claim because he has two children. I'm such a nice guy huh. Anyway I don't think it will make a huge difference, but let's see.

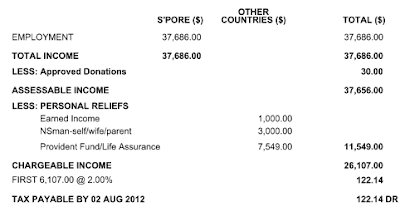

In 2012 I paid S$122.14

If chargeable income reduced by S$2000, I would only need to pay S$82.14, S$40 difference.

If reduced by S$9000, I won't have to pay anything, S$122.14 difference.

In 2013 I paid S$330.83

If chargeable income reduced by S$2000, I would only need to pay S$281.83, S$49 difference.

If reduced by S$9000, I would only need to pay S$123.04, S$207.79 difference.

Summary

So if I get S$2000 relief for 2012 and 2013, I would pay S$89 lesser.

As for S$9000 relief, I would pay S$329.93 lesser.

329.93 - 89 = S$240.93.

Not a life changing amount, my wife easily spends that amount in one or two weeks while I slog, haha, just kidding, not that she doesn't want to work but she's not healthy like most people, heart surgery, life-long medication and all, not easy for her also.

On Wednesday, while looking through my tax forms, I saw the NSman Self Relief and Earned Income Relief which reduced my taxable amount by a total of S$4000. So I looked them up on IRAS website and found that I was actually eligible for two other claims. You can check out the full list of reliefs here.

Spouse Relief

I am eligible for this one because my wife is not working, so I can claim S$2000 for this. I have never made the claim, but luckily when I checked with IRAS via email, seems like it is possible to claim retrospectively, I was married in 2010 so I can start claiming from there.

Parent Relief

I can claim S$7000 for this on my mother because she is not working, but my brother-in-law has made the claim and there can only be one claimant, when I checked with him, he told me he can withdraw if I wish to claim but I decided to let him claim because he has two children. I'm such a nice guy huh. Anyway I don't think it will make a huge difference, but let's see.

In 2012 I paid S$122.14

|

| 2012 Income Tax |

If chargeable income reduced by S$2000, I would only need to pay S$82.14, S$40 difference.

If reduced by S$9000, I won't have to pay anything, S$122.14 difference.

In 2013 I paid S$330.83

|

| 2013 Income Tax |

If chargeable income reduced by S$2000, I would only need to pay S$281.83, S$49 difference.

If reduced by S$9000, I would only need to pay S$123.04, S$207.79 difference.

Summary

So if I get S$2000 relief for 2012 and 2013, I would pay S$89 lesser.

As for S$9000 relief, I would pay S$329.93 lesser.

329.93 - 89 = S$240.93.

Not a life changing amount, my wife easily spends that amount in one or two weeks while I slog, haha, just kidding, not that she doesn't want to work but she's not healthy like most people, heart surgery, life-long medication and all, not easy for her also.

Comments